A Resilient Wealth Preservation Strategy Enabled by Expert Macro Fundamentals, Machine Learning, and Climate Technology

The Atlas Investment Strategy:

A robust, systematic strategy, guided by our Chief Economist and Co- Portfolio Manager Dr. Nouriel Roubini, together with a team of experienced financial market professionals.

Dynamic allocations to multiple asset classes based on a model taking in datasets and enhanced through machine learning analysis.

Designed to deliver economic security by investing in America's foundational assets, including land, agriculture, gold, and credit.

-

In our opinion, a resiliency-focused portfolio should include a hedge against inflation and geo-economic risks, in short-term and inflation-indexed sovereign bonds and gold.

-

The second component is composed of strategic commodities, particularly agricultural commodities, aimed at strengthening the backbone of a resilient and inclusive, global economy.

-

The third is climate-resilient real estate and infrastructure. Specifically, we focus on real estate investment trusts (REITs) in advanced economies that demonstrate stability and are positioned to mitigate climate-related risks.

-

the fourth component is a mix of alternative strategies that may include Total Return Swaps, Options and selective sector exposure to hedge the portfolio against short and medium term risk, such as Defense and Cybersecurity sectors in the current heightened geo-political risk environment

Stability Meets Opportunity:

The Atlas Approach to Strategic Investing

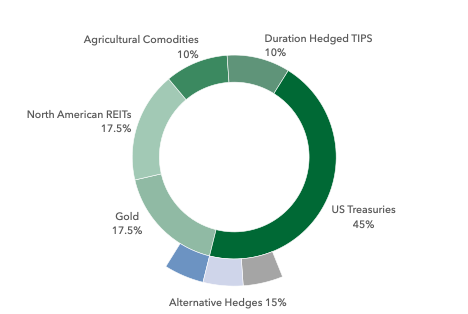

The Atlas Investment Strategy aims to enhance American economic stability and ensure future prosperity through strategic investments in U.S. Treasuries, real estate, gold, and agricultural commodities. It is designed to complement U.S. Treasury holdings by balancing them against an optimized basket of low or negatively correlated assets that include Real Estate Investment Trusts (REITs), gold, and strategic agricultural commodities. Additional support is derived from alternative uncorrelated investment strategies provided by the top US banks. We believe this diversified approach complements the safety and liquidity of Treasuries with the growth potential of other asset classes, mitigating risks and enhancing overall portfolio resilience.

The Atlas Investment Strategy includes:

This is a base allocation and may not reflect current allocations.

U.S. Treasuries

Core holding for stability and liquidity.

Climate Resilient Real Estate Investment Trusts

Focused on sustainability, climate adaptability, and communities of the future.

Gold

Hedge against currency devaluation and geopolitical uncertainty.

Treasury Inflation-Protected Securities

The most direct mechanism for inflation protection.

Strategic Agricultural Commodities

Investing in agriculture and food security.

International Partnerships (15% of illiquid REIT allocation)

Enhancing the strategy with global expertise.

Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Atlas’ website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Investment Advisory Services offered through Atlas, a Registered Investment Advisor with the U.S. Securities & Exchange Commission. Registration does not imply a certain level of skill or training. Past performance is not indicative of future results.